Understanding Fraud

Fraud, in the context of online transactions, encompasses a range of deceptive activities aimed at gaining unauthorized access to sensitive information or manipulating payment processes for illicit gains. Common forms include identity theft, chargeback fraud, and account takeover, each presenting unique challenges for both merchants and consumers.

What is Payment Fraud?

Payment fraud refers to any deceptive or illegal activity conducted to obtain financial assets through fraudulent means during a transaction. It involves the unauthorized use of payment methods or manipulation of the payment process to gain financial benefits dishonestly. The goal is typically to access funds, goods, or services without proper authorization, causing financial losses to individuals, businesses, or financial institutions.

Payment fraud can take various forms, and attackers are often creative in finding new methods. Here are some common types of payment fraud:

Card-not-present (CNP) Fraud

Fraud occurring in transactions where the cardholder and card are not physically present, such as online or phone transactions.

Prevention: Implement AVS and CVV checks, use two-factor authentication, employ secure payment gateways, and educate customers about secure online practices.

Identity Theft

Stealing personal information to impersonate someone and make fraudulent transactions.

Prevention: Protect personal information, use strong passwords, and enable two-factor authentication. For high value transactions you can conduct customer identity verification.

Phishing

Fraudsters attempt to trick individuals into providing sensitive information by posing as trustworthy entities. Fraudulent actors then use this information to process unauthorized transactions.

Prevention: Educate users about phishing tactics, use email filters, and verify requests for sensitive information.

Account Takeover (ATO)

Unauthorized access to a user’s account, often through stolen credentials.

Prevention: Encourage strong, unique passwords, implement multi-factor authentication, and monitor accounts for unusual activity.

Chargeback fraud also known as “Friendly Fraud”

A customer makes a purchase online and then disputes or requests a chargeback, despite receiving the goods or services.

Prevention: Clearly communicate refund policies, provide excellent customer service, and maintain detailed transaction records.

Merchant’s Shield: Strengthening Security Measures for Fraud Prevention

In the ever-evolving landscape of online transactions, merchants stand as guardians of their customers’ data and financial security. Employing robust security measures is not only a responsibility but also a necessity in the fight against fraud. Here are key strategies for merchants to fortify their defenses:

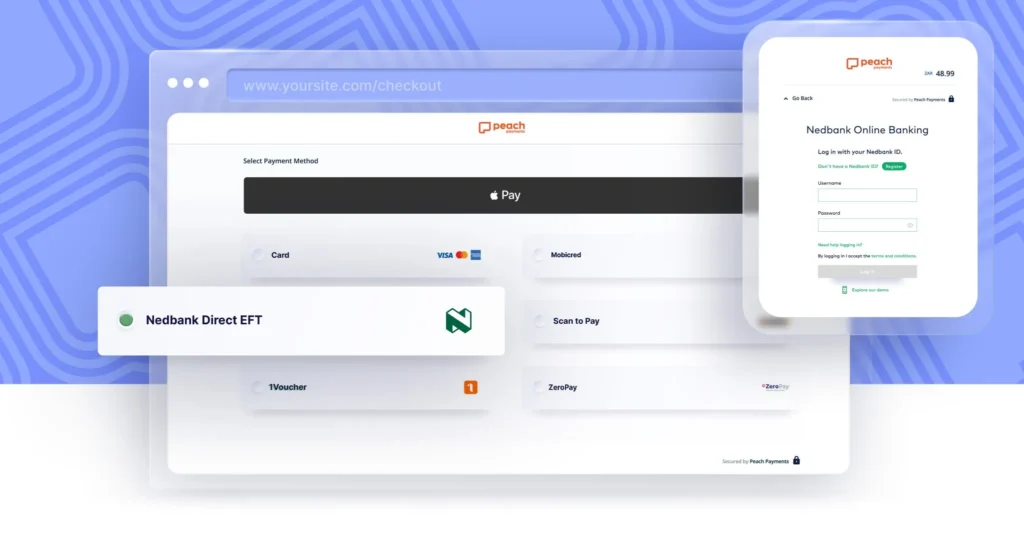

Use Secure Payment Gateways

Ensure that your online store uses reputable and secure payment gateways. This adds an extra layer of security to transactions.

Collect More Information During Checkout

Gathering additional information during the checkout process can provide valuable data points for fraud detection.

Regularly Update Security Software

Keep your website’s security software, plugins, and platforms up to date. Regular updates often include security patches that protect against vulnerabilities.

Monitor Customer Behavior

Use analytics tools to monitor customer behavior and detect unusual patterns, such as multiple transactions from the same IP address in a short period.

Educate Staff

Train your staff to recognize and respond to potentially fraudulent activities. Provide guidelines on what to look for and the steps to take when suspicions arise.

Regularly Review Orders

Manually review high-risk orders, especially those with expedited shipping requests. Look for inconsistencies and follow up with customers if needed.

Secure Your Website

Use HTTPS to encrypt data transmitted between your website and customers. This helps protect sensitive information from being intercepted.

Have a Clear Return Policy

Clearly communicate your return policy to customers. Fraudsters may be deterred if they know there are stringent return procedures in place.

Implement 3D Secure (3DS)

Integrate 3D Secure, an additional layer of authentication for online credit and debit card transactions. This protocol, often known as “Verified by Visa” or “Mastercard SecureCode,” adds an extra step during the checkout process where customers must authenticate themselves with a password or one-time code. This helps verify the legitimacy of the transaction and reduces the risk of unauthorized use of credit cards.

Smart Shopping: Identifying Red Flags for Secure Online Transactions

Shopping online provides unparalleled convenience, but it’s essential for customers to remain vigilant to protect themselves from potential fraud. Here’s a guide on what customers should be on the lookout for:

Verified and Secure Websites

Verify the legitimacy of the website before making a purchase. Look for “https://” in the URL, indicating a secure connection. Additionally, check for a padlock icon in the address bar. Legitimate online retailers prioritize the security of your data.

Read Reviews and Ratings

Before making a purchase, read reviews and ratings from other customers. Genuine feedback can provide insights into the reliability of the seller and the quality of the products or services.

Beware of Too-Good-to-Be-True Deals

Exercise caution when encountering deals that seem too good to be true. Scammers often lure unsuspecting customers with unrealistically low prices to extract sensitive information or deliver substandard products.

Check for Contact Information

Legitimate online retailers provide clear and accessible contact information, including a physical address and customer support details. Be wary of websites that lack transparent communication channels.

Scrutinize Payment Methods

Use secure payment methods, such as credit cards or reputable online payment platforms. Avoid sharing sensitive information, such as your social security number, with online sellers.

Be Cautious with Personal Information

Reputable online stores typically require only essential information for the transaction. Be cautious if a website requests unnecessary personal details. Legitimate businesses prioritize customer privacy.

Review Return and Refund Policies

Understand the return and refund policies of the online store before making a purchase. Legitimate sellers provide clear information about the process for returning or exchanging products.

Summary

As the digital landscape evolves, so too must our strategies for combating fraud. Peach Payments stands at the forefront of this battle, committed to not only providing a secure payment gateway but also fostering a collective effort between merchants and consumers to thwart fraudulent activities. Through education, advanced technology, and constant vigilance, Peach Payments aims to create a digital ecosystem where transactions can be conducted with confidence and trust.