After the high-spending frenzy of Black Friday and the festive season, many South Africans start the year looking for smarter ways to manage their budgets. With rising costs and stretched wallets, flexible payment solutions have never been more essential.

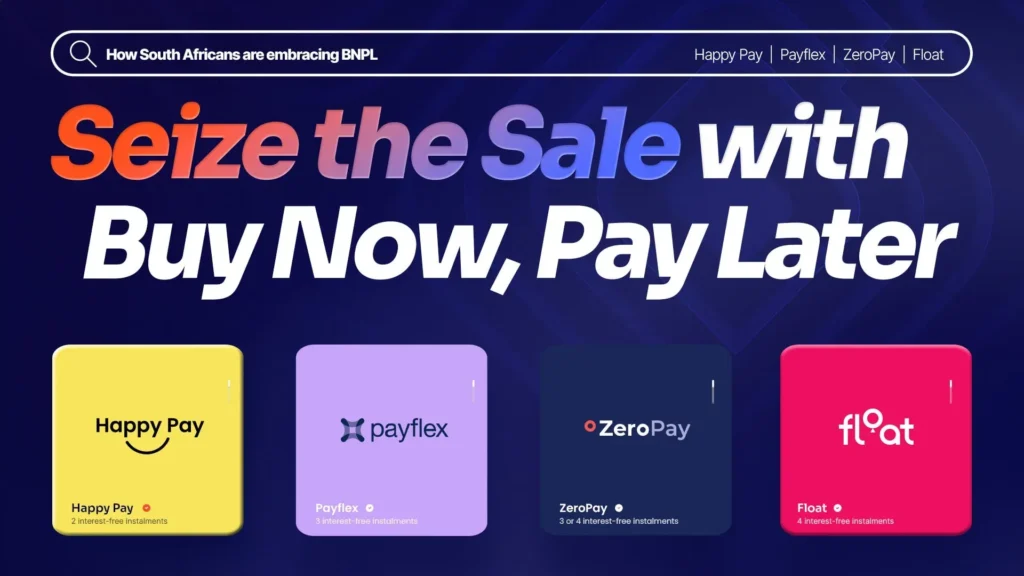

That’s where Buy Now, Pay Later (BNPL) solutions like Payflex, ZeroPay, Happy Pay, and Float come in. This increasingly popular payment method is reshaping the way consumers shop, allowing them to split payments over time without relying on traditional credit. And it’s not just useful during slower months—our data shows that BNPL is also gaining traction during peak retail moments, including Valentine’s Day, Easter, and Mother’s Day. In fact, BNPL usage in the lead-up to Valentine’s Day surged by 78% year-on-year, comparing transaction volumes between 2023 and 2024. BNPL usage in the lead-up to Easter saw a 96% year-on-year increase, comparing transaction volumes between 2023 and 2024. AND ahead of Mother’s Day 2024 BNPL transactions more than doubled, rising by 104% compared to 2023

According to the 2024 Online Retail Report, nearly half of enterprise merchants now offer BNPL as a payment option. The appeal is clear: by giving customers more flexibility, businesses can increase conversions, grow basket sizes, and maintain steady sales throughout the year.

What is BNPL, and How Does It Work?

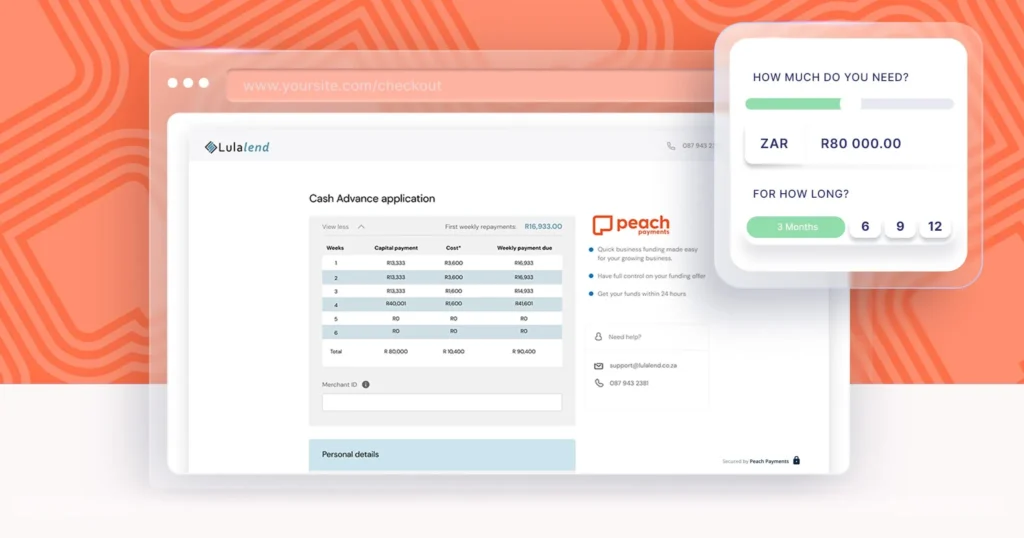

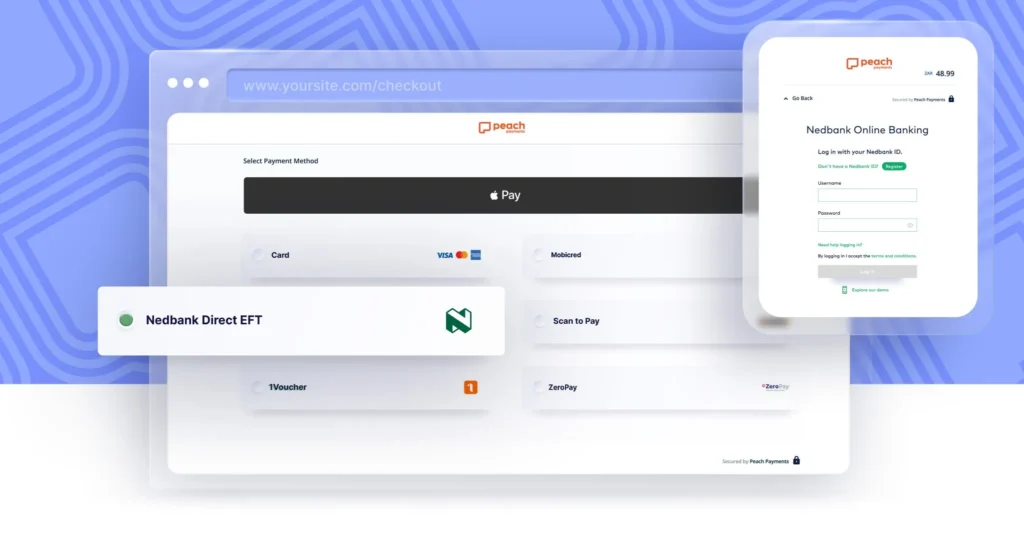

BNPL gives customers the flexibility to pay over time while ensuring merchants get paid upfront, eliminating financial risk. Each BNPL provider offers easy sign-up, accessibility, and wide consumer reach, making it a seamless payment method for both shoppers and businesses.

Here is a list of the Peach Payment’s BNPL offering:

| BNPL Provider | Payment Terms | Price | Key Benefits |

| Payflex | 3 or 4 interest-free instalments | SME: 5.25% + R4 + R1.50 per transaction

Enterprise: Volume-based |

✅ Covers your risk with FlexiAdvance

✅ Payflex charges only on successful transactions ✅ Customers get instant approval when applying for an account |

| ZeroPay | 3 interest-free instalments | 4.75% + R2 + R1.50 per transaction

Enterprise: Volume-based |

✅ Instant customer sign-up for a smooth checkout experience

✅ Tailored transaction fees based on average basket size ✅ Minimal risk—you receive full payment upfront, while we manage any missed payments |

| Float | 4 interest-free instalments | 6.5% + R24 + R1.50 per transaction

Enterprise: Volume-based |

✅ Offers longer repayment periods for consumers

✅ Access to 5 million pre-approved credit card holders ✅ No interest, no fees, no extra credit, and no catch |

| Happy Pay | 2 interest-free instalments | 4.99% + R4 + R1.50 per transaction

Enterprise: Volume-based |

✅ Zero credit risk—Happy Pay assumes full liability, ensuring merchants get paid upfront

✅ Fast approval—customers get credit approval in 30 seconds ✅ Millions of South Africans have already embraced Happy Pay |

Why Should Your Business Offer BNPL?

✔ Boost Sales & Conversions – Give customers more ways to pay and watch your checkout rates improve.

✔ Increase Basket Sizes – Shoppers tend to spend more when they can split payments over time.

✔ Reduce Cart Abandonment – Offering BNPL encourages customers to complete their purchases.

✔ Risk-Free for Merchants – You get paid upfront, while the BNPL provider takes care of the rest.

BNPL isn’t just a passing trend—it’s reshaping retail and helping businesses maximise sales all year round.

Is your business ready to seize the sale? Get in touch with Peach Payments today to start offering BNPL at checkout!