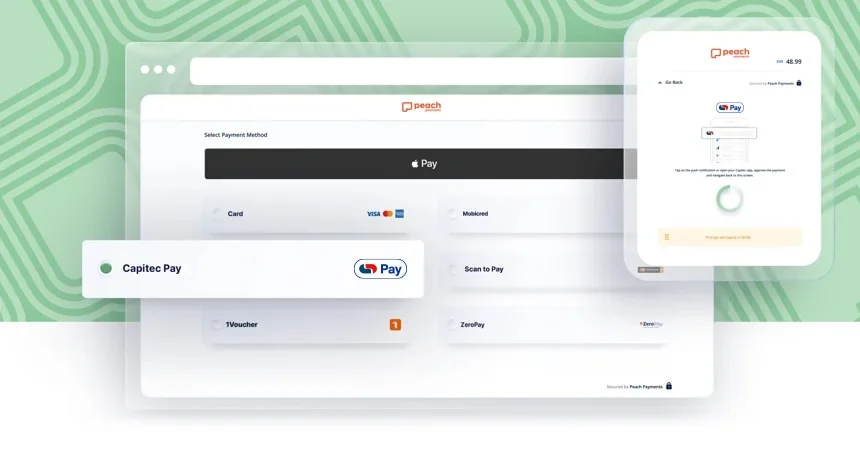

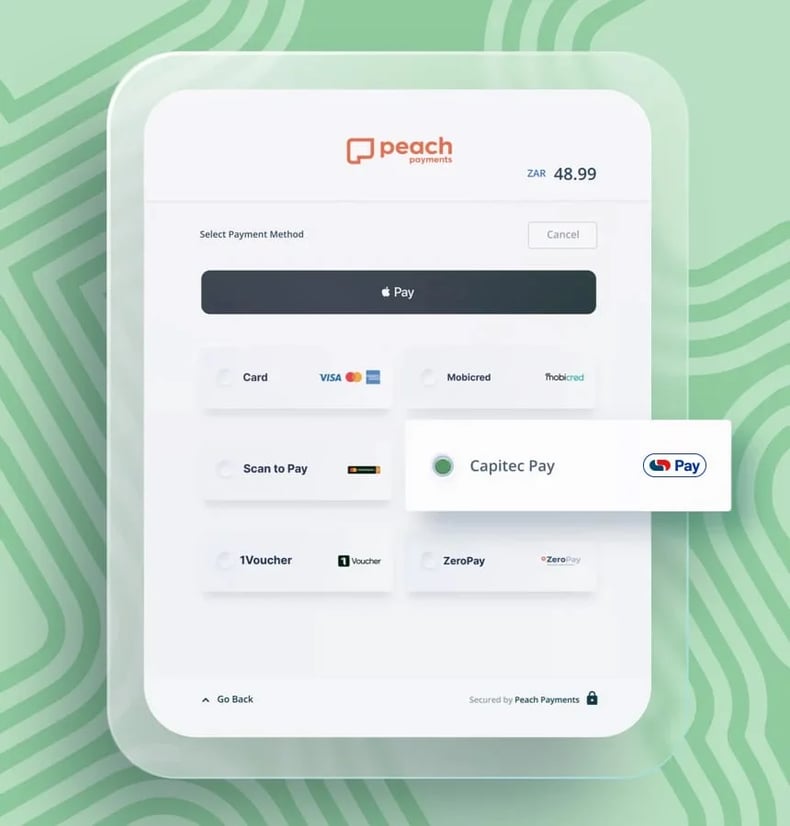

Peach Payments, among other players, has partnered with Capitec to launch Capitec Pay as part of their online payment gateway, a new open banking payment method that allows online shoppers to make secure and safe payments directly from their Capitec Bank account.

Open banking is a banking practice that provides third-party financial service providers open, permission-based access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions. It is widely considered a key way to democratise financial services, as it gives consumers more choices in how they manage their money. The number of open banking users worldwide is expected to grow at an average annual rate of nearly 50% between 2020 and 2024.

Capitec Pay is a proprietary immediate-payment initiation API solution that is based on open banking standards and best practices. It allows Capitec banking clients to pay securely online by entering their phone numbers and then authorising the payment in-app.

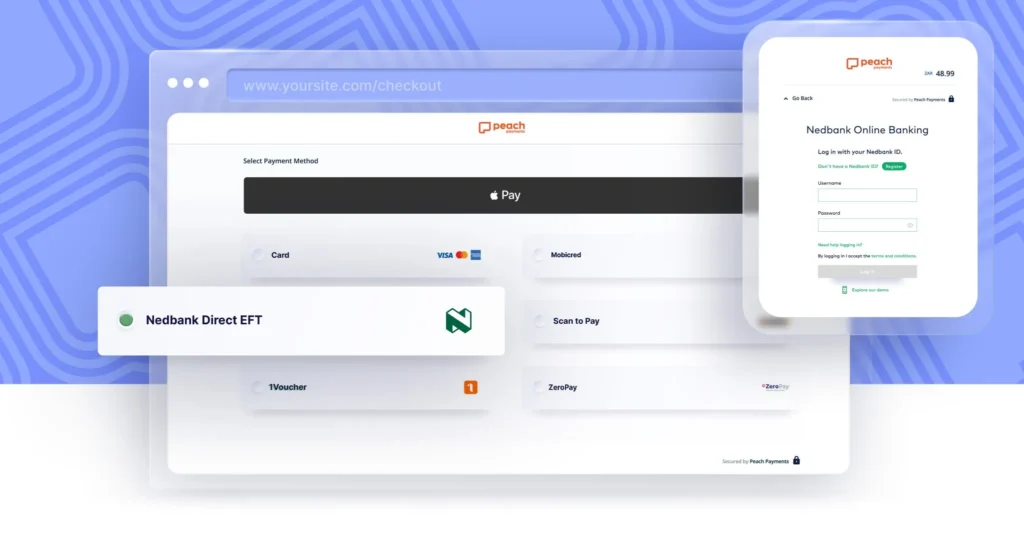

Peach Payments’ integration with Capitec Pay offers far better security than traditional Instant EFT solutions, which rely on screen-scraping and require banking users to share sensitive account login information such as usernames and passwords. The API-based solution not only reduces the risk of fraudulent activity but also makes it easier for Capitec’s broad base of banking clients to pay their basic bills online.

Says Jerome Passmore, Head of Capitec Pay, “Shopping online is quick and easy, now checking out is too! Our banking clients can leave their wallets at home and use Capitec Pay to make safe, card-free payments by simply approving their payment on our app. There is no need to enter card details or share bank login details at checkout.”

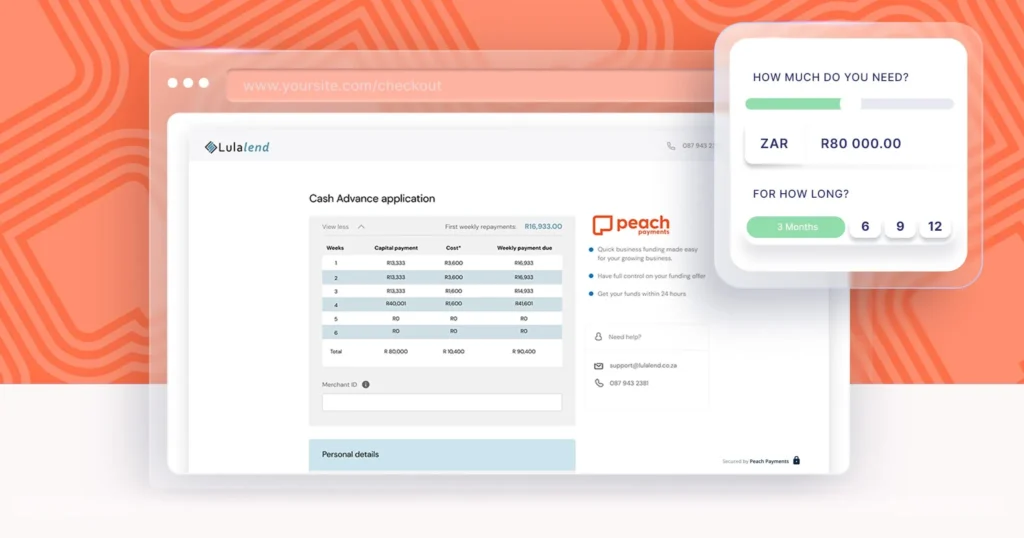

The advantages for merchants include that payments are completed instantly, with none of the transaction limitations of manual EFTs. Payment verification means merchants are not subject to fraudulent transaction charge-backs. In addition merchants’ administrative work is reduced as a result of automated payment-to-transaction allocations in their Peach Payments dashboard.

Says Rahul Jain, Peach Payments co-founder and CEO, “Capitec Pay is a sign of our commitment to open banking and real-time payments. We continue to work with banks to support official integrations which not only deliver a superior real-time experience but also far greater security to bank account holders and users.”.