In the world of digital commerce, every second matters. Customers demand speed, simplicity, and a frictionless experience. Businesses need flexibility, scalability, and seamless branding. Enter Embedded Checkout, Peach Payments’ cutting-edge solution designed to redefine how merchants handle online transactions.

With an embedded checkout experience, the payment transaction is completed within the merchant’s website or application, without redirecting the user to an external payment provider page.

As Embedded Checkout takes centre stage, Peach Payments is phasing out COPYandPAY by Q1 2025. But this isn’t just about retiring an old system—it’s about unlocking a future where payments aren’t just functional but transformative.

The Problem With Good Enough

COPYandPAY was a good solution for its time. It provided merchants with a simple, secure way to handle card payments. But let’s face it: “good enough” isn’t enough anymore. Customers now expect a checkout experience that’s as dynamic as the brands they love.Limited payment methods are a dealbreaker. And generic checkout pages? They’re so 2015.

That’s where Embedded Checkout comes in. Watch our FAQ video as you transition from COPYandPAY to Embedded Checkout here

Watch our FAQ video as you transition from COPYandPAY to Embedded Checkout

Why Embedded Checkout Isn’t Just an Upgrade

Embedded Checkout isn’t an iteration—it’s a revolution. It takes everything COPYandPAY did well and amplifies it while addressing the demands of a more sophisticated online economy.

1. Your Brand, Your Rules

Forget cookie-cutter checkouts. Embedded Checkout lets merchants customise their payment pages, blending them seamlessly with their site’s look and feel. The result? A cohesive customer experience that builds trust and strengthens your brand.

2. Payment Methods for a Diverse World

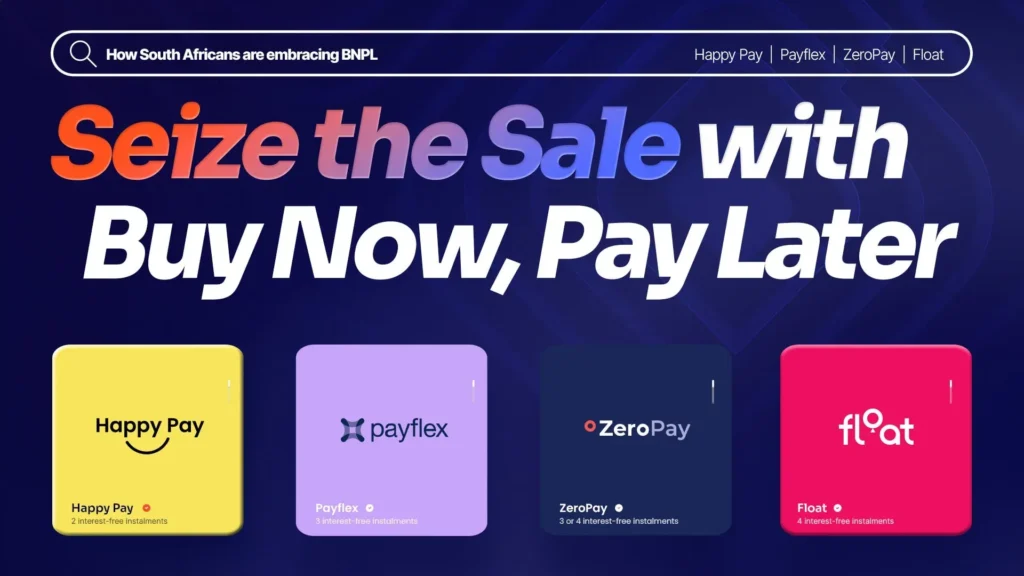

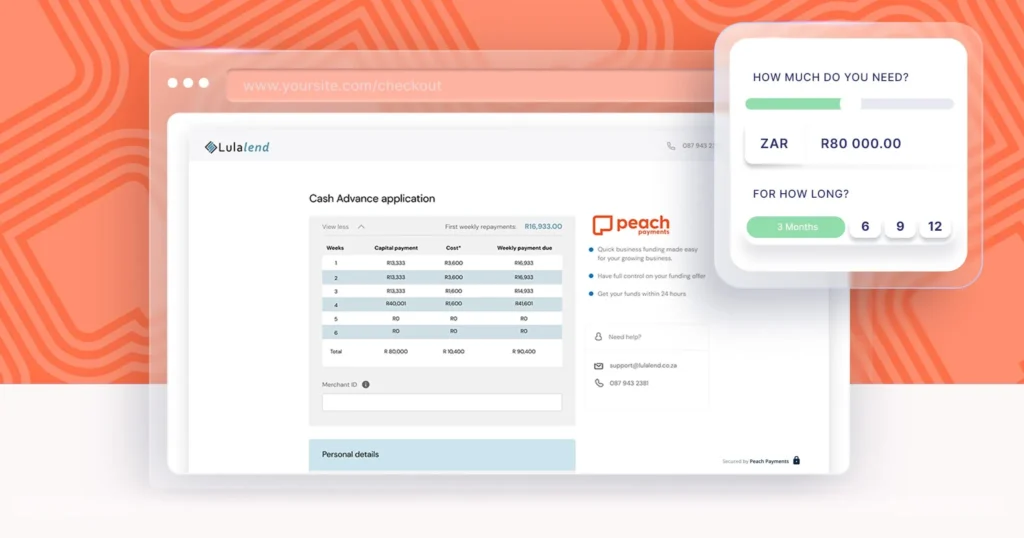

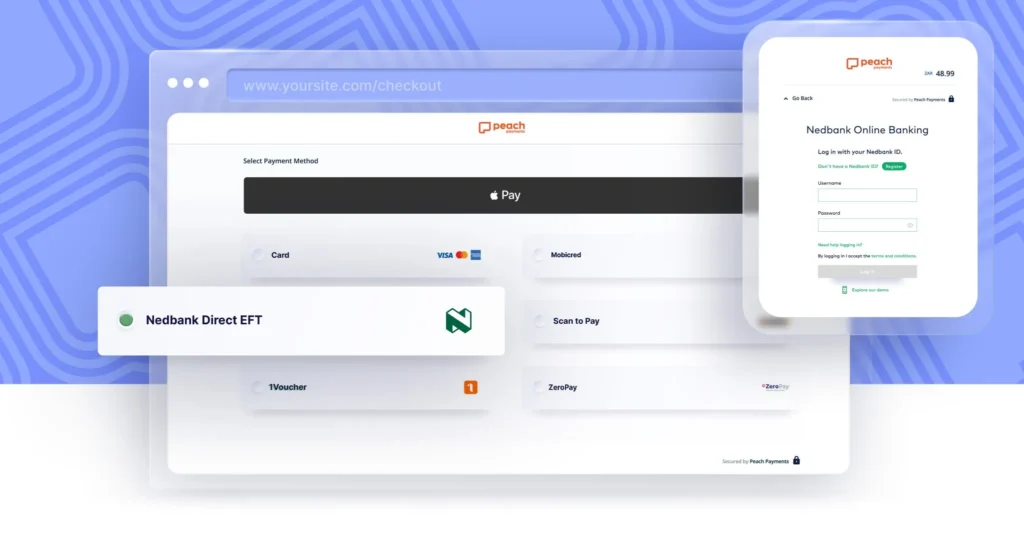

Today’s shoppers want options, and Embedded Checkout delivers. From Pay by Bank to BNPL and Apple Pay, the list goes on and the platform offers payment flexibility that fits the preferences of any customer.

3. Security Without the Headache

Compliance isn’t sexy, but it’s essential. Embedded Checkout is fully PCI DSS v4.x compliant, meaning merchants can focus on growing their business while we handle the heavy lifting on security.

4. Pre-Authorisation: The Power of Flexibility

Holding funds without immediate charges might sound small, but it’s a big deal for industries like hospitality and car rentals. Pre-authorisation lets you reserve funds until the final price is locked, giving you room to breathe in dynamic pricing scenarios.

5. Click. Buy. Repeat.

One-click checkout isn’t just a feature—it’s a loyalty strategy. For returning customers, it’s the difference between a purchase and an abandoned cart.

Why Phase Out COPYandPAY?

The decision to phase out COPYandPAY by Q1 2025 wasn’t taken lightly. But as the digital landscape evolves, so must the tools we offer. COPYandPAY served its purpose as a reliable gateway for card payments. Yet, it lacked the adaptability and sophistication that modern merchants need to stay competitive.

Embedded Checkout changes the game. It’s not just a replacement; it’s an evolution—one designed to meet and exceed the expectations of both merchants and their customers.

Why Now?

We get it. Transitions can be daunting. But moving to Embedded Checkout isn’t just about preparing for COPYandPAY’s sunset—it’s about future-proofing your business. The clock is ticking, and the benefits are clear:

- Better conversions: Keep customers on your site, no redirects required.

- Streamlined operations: A single integration supports multiple payment methods.

- Fewer headaches: Compliance and security are built-in.

Embedded Checkout isn’t just about payments—it’s about empowering merchants to scale and think bigger.

The Future of Payments Starts Here

Ready to embrace the future? Embedded Checkout isn’t just a tool—it’s your competitive edge in a crowded market. Don’t wait until Q1 2025 to make the move.

Get started now, and see how Embedded Checkout can transform your payments into a seamless, branded, and powerful part of your business strategy.